Divorce is never easy, but the complexity increases when high assets are involved. For individuals facing a high-asset divorce in California, understanding the unique family law landscape is essential to protecting your interests. This article will help you understand the process and what it entails.

Understanding High Asset Divorce

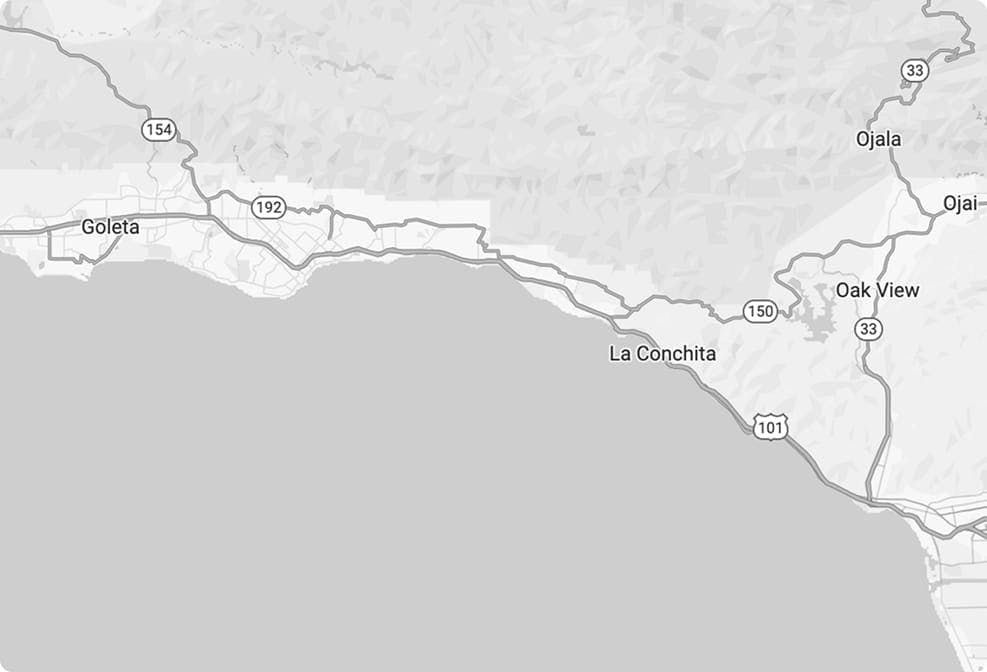

High-asset divorces typically involve individuals or couples with substantial assets, including businesses, real estate, investments, and other high-value properties. These divorces require meticulous attention to detail and careful navigation of California's community property laws. The high asset divorce lawyers in Ventura at Bamieh & De Smeth have extensive experience handling these complex cases and work diligently to protect clients’ financial interests.

Key Considerations for High Asset Divorces

Some factors that need to be considered:

- Asset Identification and Valuation: Identifying marital versus separate assets and determining their value is crucial. This often involves appraisers, accountants, and other financial experts.

- Complex Property Division: California follows community property laws, which means assets acquired during the marriage are divided equally. Disentangling holdings in a high-asset divorce can be challenging and often requires negotiation and strategic planning.

- Spousal Support: Also known as alimony, spousal support can be contentious. High-asset divorces may involve significant alimony payments due to the lifestyle established during the marriage.

Client Successes Why Clients Choose Us

I cannot recommend Ron Bamieh and Anzac Jacobs highly enough.

I was wrongly accused of a misdemeanor charge. From the very beginning, Ron approached my case with incredible patience, empathy, and professionalism. He took the time to listen, understand my concerns, and explain every step of the legal process in a way that was clear and reass...

—Andrew C.

Exceptional skill and professionalism

Danielle De Smith handled our case against a school district in Ventura County with exceptional skill and professionalism. I initially approached the situation as a fiercely protective mother, ready to fight, but Danielle’s grace, expertise, and strategic approach proved fa...

—Krista Nowak

I would highly recommend the Law Office of Bamieh and de Smith!

We worked with Atty Jacobs to help us with an issue with our loved one and things could have been so much worse if we hadn’t of had his expertise and compassion. When you’re in a situation when you need help with a loved one, not only are you desperate but you’r...

—Eleanor Torres

Bamieh & Smith were awesome and would definitely recommend.

Mr. Anzac Jacob's was one of the best Lawyer I could've been blessed with. Top to bottom , Professional, honest, caring, and he has a great heart. He did his best for me. He never made me feel like he did not care about my situation, without Mr. Jacobs and Mr. Bamieh, I think I w...

—Frankie Estanol

I would recommend hiring Bamieh & De Smeth.

They are very transparent and up front with you regarding your matter. Never having any experience with the matter I hired them for, they explained everything that was happening, would be happening or could happen. Meghan Sherry took on our matter and made us free welcome and nev...

—Tammy Donovan

First time I met Ron he welcomed me with open arms.

His sincerity and willing to help me was shown immediately. Ron stood by my side, showed up for me and checked in on my emotional well being every step of the way. Not only is he a great lawyer but a genuine person who sees good in others and wants to help good people.

Words...

—Brandee Herrera

Professional, honest, and confident

From my initial conversation with Ron and his team, I was put at ease by their professionalism, honesty and confidence. He clearly described the process and what I could expect in the following months. He was thorough in his preparation and in court, he was calm and calculat...

—Jeff

Grateful for exceptional legal support with a better-than-expected outcome

I am so grateful to my neighbor who recommended this law firm. After being in a terrible accident where I was hit by a car on my bicycle, I wasn’t sure about contacting a lawyer, but after months and months of pain and frustration I decided to give them a call. I’m so...

—Susie Avchen

I highly recommend this law office.

From the moment I stepped in for my first consultation, I felt welcomed and reassured. The team is professional, compassionate, and truly listens to their clients. I left that first meeting with a sense of relief, knowing I was in capable and trustworthy hands. Thank you for your...

—S.B.

Amazing firm.

Ron is straight to the point and will give his honest opinion on the case. Very knowledgeable team that will do their best. I am personally impressed on how they handled my case. They gave me light at the end of a tunnel that seemed endless.

—John

Steps to Take in a High-Asset Divorce

Ways to approach a high-asset divorce:

Consult with Legal and Financial Experts

The first step in any high-asset divorce is to consult an experienced high-asset lawyer. An attorney specializing in high-asset divorce will understand the differences specific to California law. They can also connect you with financial advisors, forensic accountants, and appraisers to ensure all assets are accurately identified and valued.

Gather and Organize Financial Documents

Accumulating all relevant financial documents as soon as possible is critical, such as bank statements, investment accounts, tax returns, real estate titles and valuations and business financial statements.

Identify Separate vs. Community Property

Understanding what is considered community property (assets acquired during the marriage) and separate property (assets owned before marriage or acquired through inheritance or gift) is essential. California law generally mandates an equal division of community property, but individual property remains with its original owner.

Evaluate Spousal Support Needs

Consider the probable need for spousal support. Discuss with your attorney the possibility of temporary support during the divorce proceedings and long-term support following the divorce. Factors such as the marriage's duration, each party's financial situation, and standard of living will influence support calculation.

Consider Tax Implications

High-asset divorce can have significant tax consequences. Consulting with a tax expert can help you understand these implications and plan accordingly. Capital gains taxes, property division, and spousal support can all impact your tax liability.

Request a Free Consultation

Contact Us

Best Law Firm in Ventura County

Ventura County Reporter (2021 - 2022)

Top 5% of Lawyers in California

California Super Lawyers (Ron Bamieh)

Favorite Law Firm in West County Ventura

Ventura County Star

Family Friendly Law Firm of the Year

Santa Barbara Women Lawyers (2022)

Our Experienced Legal Team

Managing Attorney, Partner Danielle De Smeth

Attorney & Partner Jennifer Yates

Attorney Jason D. Frantz

Attorney Anzac Jacobs

Attorney Thelma Corsa

Attorney Meghan Sherry

Attorney Charlotte Krem

Common Challenges in High Asset Divorces

Business Valuation and Division

Determining its value can be challenging when one or both spouses own a business. Hiring a forensic accountant to provide an objective valuation is a good idea.

Hidden Assets

In some high-asset divorces, one party may attempt to hide assets to prevent them from being divided. Forensic accounting can uncover undisclosed or hidden assets, ensuring a fair distribution.

Complex Investments

Stocks, bonds, retirement accounts, and other investments need careful consideration. These assets require professional evaluation and a strategic approach to divide them in a manner that preserves their value and considers tax implications.

Bamieh & De Smeth, PLC

If you're trying to manage a high asset divorce, consulting with an experienced high asset divorce attorney in Ventura can be valuable. Their expertise will help you understand your rights and obligations and provide critical support throughout the legal proceedings.

Contact our firm today for advice and representation to schedule a consultation. We're here to guide you through each step of the process, ensuring your assets and interests are safeguarded.

Stay Informed With Our Latest Legal Insights

Our blog offers valuable information on legal topics, recent case studies, and tips to help you navigate the legal system with confidence. Explore our latest posts below.